Sow The Wind, Reap the Whirlwind

The Trump Administration's "whirlwind" comes in the form of mortgage fraud allegations

In 1940, Royal Air Force Air Marshal Arthur “Bomber” Harris gave a memorable speech announcing the beginning of a bombing campaign over Germany.

"The Nazis entered this war under the rather childish delusion that they were going to bomb everybody else and nobody was going to bomb them. At Rotterdam, London, Warsaw, and half a hundred other places, they put that rather naive theory into operation. They sowed the wind and now they are going to reap the whirlwind.”

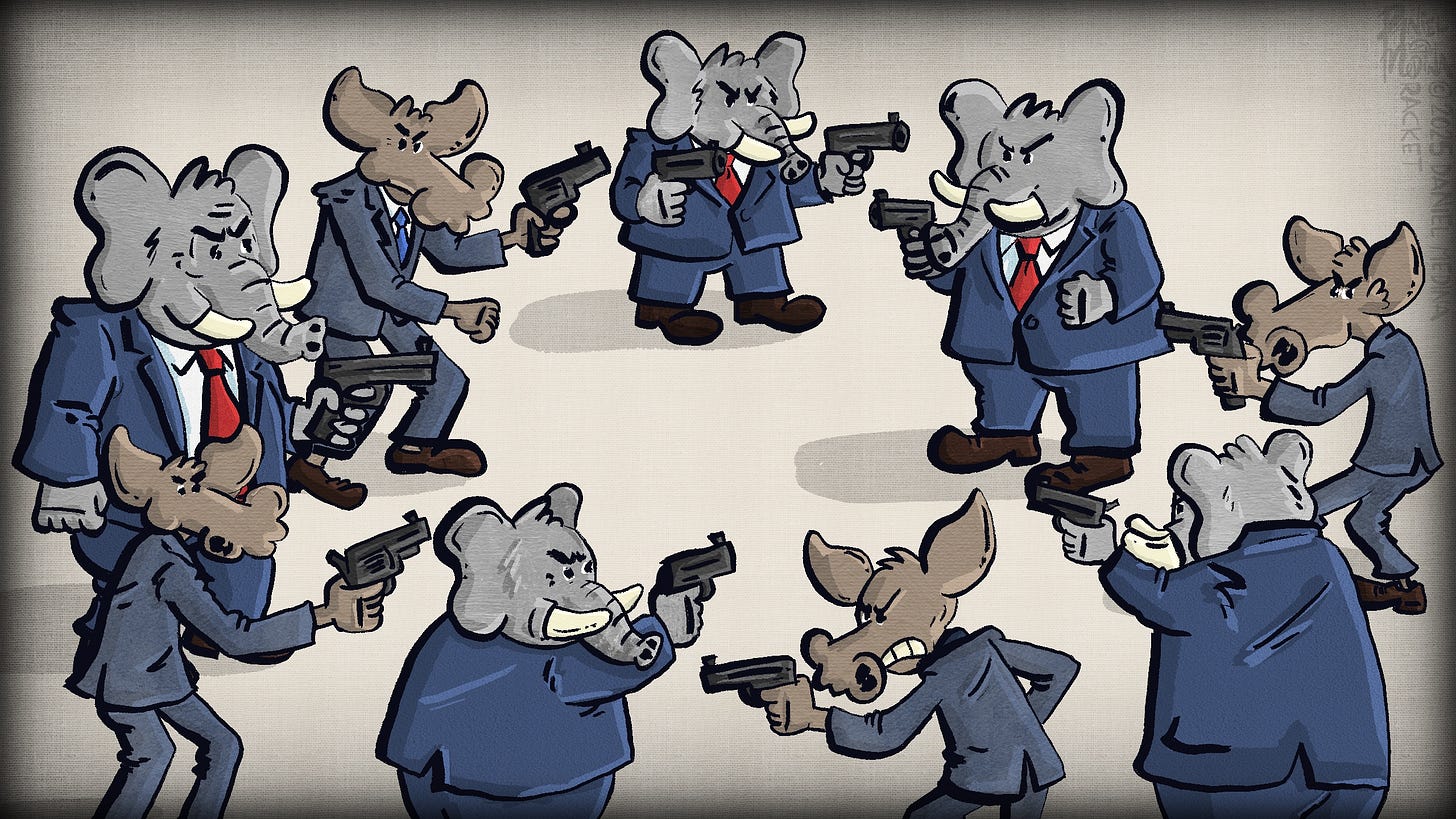

The same can be said for using the justice system to go after your political enemies when you are in power. Some day, like this week, your enemies will be in power and do unto you as you did to them.

In 2022, New York Attorney General Letitia James brought a civil case against then-former President Trump, after she made going after him the central issue in her 2018 campaign.

That clip is not aging well!

The premise of James’ civil case against Trump was that he lied to a financial institution by inflating the value of a number of assets and his net worth to receive favorable rates from Deutsche Bank. A banking expert for the prosecution, Michael McCarty testified that Trump and his company, the Trump Organization, saved over $168 million through obtaining favorable loan terms on transactions personally guaranteed by Trump. Interestingly, Deutsche Bank private banker Rosemary Vrablic also testified at the trial saying the bank considered Trump a “whale” client and that they did their own due diligence on Trump’s net worth.

However, even though the loans in question were paid off on time, a judge fined Trump $355 million plus another $100 million in interest for his “ill-gotten gains.” It was a clear attempt to ruin him.

Revenge?

In the last few months, the Trump Administration has launched a trifecta of allegations that two of his sworn political enemies and another Democratic appointee have been involved in their own mortgage-related hijinks. Bill Pulte, the director of U.S. Federal Housing FHFA, has sent criminal referral letters to the Justice Department for James, U.S. Senator Adam Schiff, and Federal Reserve Board Governor Lisa Cook for suspicion of mortgage fraud. From NBC News:

U.S. Attorney General Pam Bondi has appointed a “special attorney” to probe mortgage fraud allegations against Sen. Adam Schiff, D-Calif., and New York Attorney General Letitia James … The Justice Department is also in the initial stages of an investigation of James over her successful civil fraud case against President Donald Trump, according to three people familiar with the matter.

Pulte says that Schiff — perhaps the most frequent critic of Trump during Russiagate — claimed his Washington, D.C., area home as his primary residence when he bought it in 2003. He didn’t change that designation until he refinanced in 2020. He also claimed a homestead exemption on his California home during that time period, according to Pulte. Homestead exemptions generally only apply to primary residences.

“Mr. Schiff appears to have falsified records in order to receive favorable loan terms,” Pulte writes in his criminal referral letter.

In addition, a whistleblower told FBI agents that Schiff, while on the House Permanent Select Committee on Intelligence, told staff that classified information on Trump would be leaked. Schiff has set up a legal defense fund.

James’ case appears to now focus on her Brooklyn apartment. Pulte alleges in a criminal referral letter that the apartment’s certificate of occupancy shows it has five units, but James listed it as having only four units in mortgage applications.

“It appears that Ms. James may have listed the Brooklyn, NY property as four units instead of five units in order to meet the conforming loan requirements, and thus receive better interest rates,” Pulte wrote in his April 14 letter.

Both James and Schiff have denied the accusations.

Lisa Cook

The most detailed allegation of mortgage fraud is aimed at Federal Reserve Board Governor Lisa Cook. President Biden appointed Cook to the FRB in 2022. By going after Cook, the Trump Administration is trying to kill two birds with one stone: bring the pain to a Democratic appointee and replace her with a Trump appointee. Regarding monetary policy, there are seven governors on the 12-member Federal Open Market Committee who get to vote. Bank presidents rotate on and off, but governors always have a vote on monetary policy.

As Trump has loudly made clear, he wants lower interest rates. So far, Cook has been in Chairman Powell’s camp, not being in a rush to ease policy. Presumably, a Trump appointee would support aggressively lowering interest rates.

Bloomberg News first reported on August 20th:

President Donald Trump called on Federal Reserve Governor Lisa Cook to resign after a staunch ally called for an investigation of the board member’s mortgages, intensifying his campaign on the central bank. Federal Housing Finance Agency Director Bill Pulte urged Attorney General Pam Bondi to investigate Cook over a pair of mortgages, the latest in a series of moves by the Trump administration to increase legal scrutiny of Democratic figures and appointees.

Cook’s response:

“I have no intention of being bullied to step down from my position because of some questions raised in a tweet. I do intend to take any questions about my financial history seriously as a member of the Federal Reserve and so I am gathering the accurate information to answer any legitimate questions and provide the facts.”

At issue are two homes — one in Michigan and another in Georgia — that Cook purchased in 2021 before she was nominated to the Fed. They were purchased within two weeks of each other, and Cook listed both as her primary residence on her mortgage applications. In his criminal referral letter to Attorney General Pam Bondi, Pulte says Cook later listed the Georgia home to rent in 2022, but that “she has not disclosed any rental income tied to this address.”

Cook’s financial disclosure documents show she signed a 15-year 2.5% loan on the investment property. Her Georgia property had a 30-year 3.25% mortgage; the property in Michigan has a 15-year loan at 2.875%.

Having two primary residences at the same time defies the laws of time and space so Cook has a problem there. Having one of the homes listed later as a rental also doesn’t help. Similar to Trump’s civil case, Pulte says “it appears” that Cook “has falsified bank documents and property records to acquire more favorable loan terms.”

Loan Level Pricing Adjustments

Mortgages on non-primary residences (second homes or investment properties) have a higher interest rate than primary residences because Fannie views them as riskier. Fannie (and Freddie) have what are called Loan Level Price Adjustments (LLPAs). The lender selling a borrower’s mortgage into a Fannie or Freddie mortgage security gets a lower price for the non-primary residence loan and that price adjustment gets passed on to the borrower in the form of a higher interest rate.

We can throw out the 15-year residential mortgage because Fannie and Freddie do not have LLPAs on that product. So technically, no one was harmed. If I were her, however, I’d be kicking myself. There was no interest rate advantage from listing that property as her primary residence.

However, the 30-year mortgage is a different matter.

Here is an example of how LLPA’s work. Assume you are taking out a first mortgage to purchase or refinance your primary residence and the rate is 3.25%, and the loan to value is 70% of the purchase price.

A loan originator selling to Fannie Mae today would receive a bond price of 101.75. However, if you are taking out a first lien mortgage for a second home (not primary residence), Fannie Mae would pay 2.125 points less, or a bond price of 99.625. To make up the difference, the originator would need to increase the borrower’s rate from 3.25% to 3.75%.

According to her disclosure statements, Cook took out a $540,000 mortgage on one of the homes that she claimed was her primary residence. The difference in her monthly payments between the 3.25% and 3.75% rate would be approximately $151 a month, or $1,812 a year. Sadly, Cook could have figured that relatively small amount out herself with any mortgage payment app or website and decided that committing a crime wasn’t worth it. Or maybe she did and did it anyway.

Unless Cook can show that this is all a big mistake, she committed a felony and unlike the Trump case, an entity was harmed. Was she targeted by Poulte? Probably, although Poulte stated this was part of a wider investigation into mortgage fraud. If it is all true, it doesn’t matter whether Cook was targeted for political reasons or not.

Hilariously, when asked about the Cook matter this week, Federal Reserve Bank of Kansas City President Jeffrey Schmid had this to say:

Let me say this, it’s definitely part of the application. But I also would say, if you think about how huge that application is, maybe we could start thinking about, how do we make it less paperwork-intensive as we go forward.

Paperwork! You would think that Fed officials would have gotten a clue after they were called out just a few years ago for making trades while deciding policy. That’s a nice way of putting it. Another way of putting it is trading on non-public material information. The Powell Fed has relied on the famous George Costanza defense to sort itself out in these matters.

Meanwhile, Senator Elizabeth Warren has changed her tune regarding Fed officials’ “misdeeds.” In 2021, at the height of insider trading accusations against Fed officials, she said it was “the largest ethics scandal in Federal Reserve history, and I’m deeply concerned that Chair Powell risks undermining confidence in the Fed if this matter is not taken more seriously.”

But now? The villain is Trump, and that matters more than whether the accusations are true. From Bloomberg:

I’ve long been an advocate for holding Fed officials accountable, but anyone can see that for months now, President Trump has been scrambling for a pretext to intimidate or fire Chair Powell and Members of the Federal Reserve Board while blaming anyone but himself for how his failed economic policies are hurting Americans. The President and his Administration should not weaponize the Federal government to illegally fire independent Fed Board members.

With regard to Trump’s desire to pack the Fed to get his way on monetary policy, replacing Cook probably won’t get him the bang for the buck he wants. Cook has another 12 years on her term as an FRB governor. Any replacement has a decade-long term that will survive the Trump presidency, and therefore Trump influence could wane pretty quickly as we move forward toward 2028.

Finally, to add insult to injury for the anti-Trumpers, the New York State Appellate Court last week threw out the $515 million (interest added to original penalty) penalty against Trump. Judge Peter Moulton called the size of the penalty “troubling” and questioned if the law James had used to sue Trump had “morphed into something it was not meant to do.”

These are the types of things that all these politicians do. These rules are for the “common” man and they don’t apply to “us”. There most likely was a handshake between these two parties over the type of illegalities they could both do where there would be a blind eye when it came to enforcement. The Dems broke that deal when going after Trump. Tish’s whole case may in fact be illegal if it was ever challenged against the constitution which hasn’t happened yet as this consumer law is just strange on it’s basis to begin with. Schiff should be in prison already for the death of that gay porn actor that involved him and a bunch of Meth. If we keep electing criminals they are going to run riot taking advantage of their positions every time ie; Gold Bar Bob. Who finally is where he belongs and should have been years ago. Cleaning up congress and those who make the rules for us needs to happen and if it’s both sides let’s make it so. This govt no longer works for us and anything that changes that is a positive no matter how slow it takes.

"Remember- It's not a lie, if YOU believe it."

-George Costanza