Trump’s World Liberty Financial - A Crypto Currency Revolution or Just a Bigger Trump University?

Either way, the Trumps' new business venture has made the family a lot of money

President Trump and the Trump family businesses have been making big waves in the cryptocurrency world since Trump took office this year. He signed the Genius Act, which provides clearer regulation of stablecoins as well as establishing a working group to, as the White House put it, usher in “The Golden Age of Crypto.” The problem is it’s in the interest of the Trump family’s burgeoning crypto business, World Liberty Financial (WLF), to do so. Led at least nominally by Don Jr and Eric Trump, WLF has been making huge deals.

Two questions come to mind:

Is Trump using the presidency for personal profit?

Will investors get screwed, like the investors in Trump-branded gimmicks such as Trump University?

World Liberty Financial made a big splash on September 1st when it began trading the company’s crypto token WLFI. Early investors were allowed to sell 20% of the holdings they received in 2024 and early 2025 when they invested in the company, and received tokens at 1.5 cents and 0.5 cents. The tokens started trading at 30 cents — cha-ching! — and WLFI trading volume averaged around $1 billion per day in its first week. It is estimated that the Trump family holdings in the token are now worth more than $5 billion.

There have been presidents who didn’t entirely give up running their business while in office. President Johnson, for example, directed business decisions on a private phone line he had installed in the White House bedroom.

Trump makes no secret of his crypto connections. He was listed as World Liberty Financial’s “Chief Crypto Advocate” when he took office. That has since changed to Co-Founder Emeritus. In the super competitive business of crypto, having a sitting U.S. President’s picture listed right at the top of the “About Us” web page probably helps a bit. Perhaps more than a bit.

For instance, there was a dinner May 22nd at Trump’s country club in Virginia. It was a reward for the top 25 investors who purchased the meme coin $Trump — launched three days before he took office. From Reuters:

The event, which the president promoted on social media as the “most EXCLUSIVE INVITATION in the world,” promised the top 220 holders of the $TRUMP meme coin an invite to a gala dinner with the president, while the top 25 will also enjoy “an ultra-exclusive private VIP reception” with the president as well as a “Special VIP Tour.”

Keep in mind that a meme coin can’t be used to purchase anything. Think of a baseball card collection that you invest in hoping it goes up in value when it becomes a collector’s item.

Still, Justin Sun invested $18.5 million in the meme coin, tops at the country club dinner. Sun also invested $75 million in WLFI last year. Sun was accused of fraud by the Biden SEC, but in February the SEC and Sun’s attorneys filed a joint motion to pause the case to “explore a potential resolution.” There is still no resolution.

But not to worry. The president is not profiting from these stunts or giving out favors, according to White House Press Secretary Karoline Leavitt. She lectured:

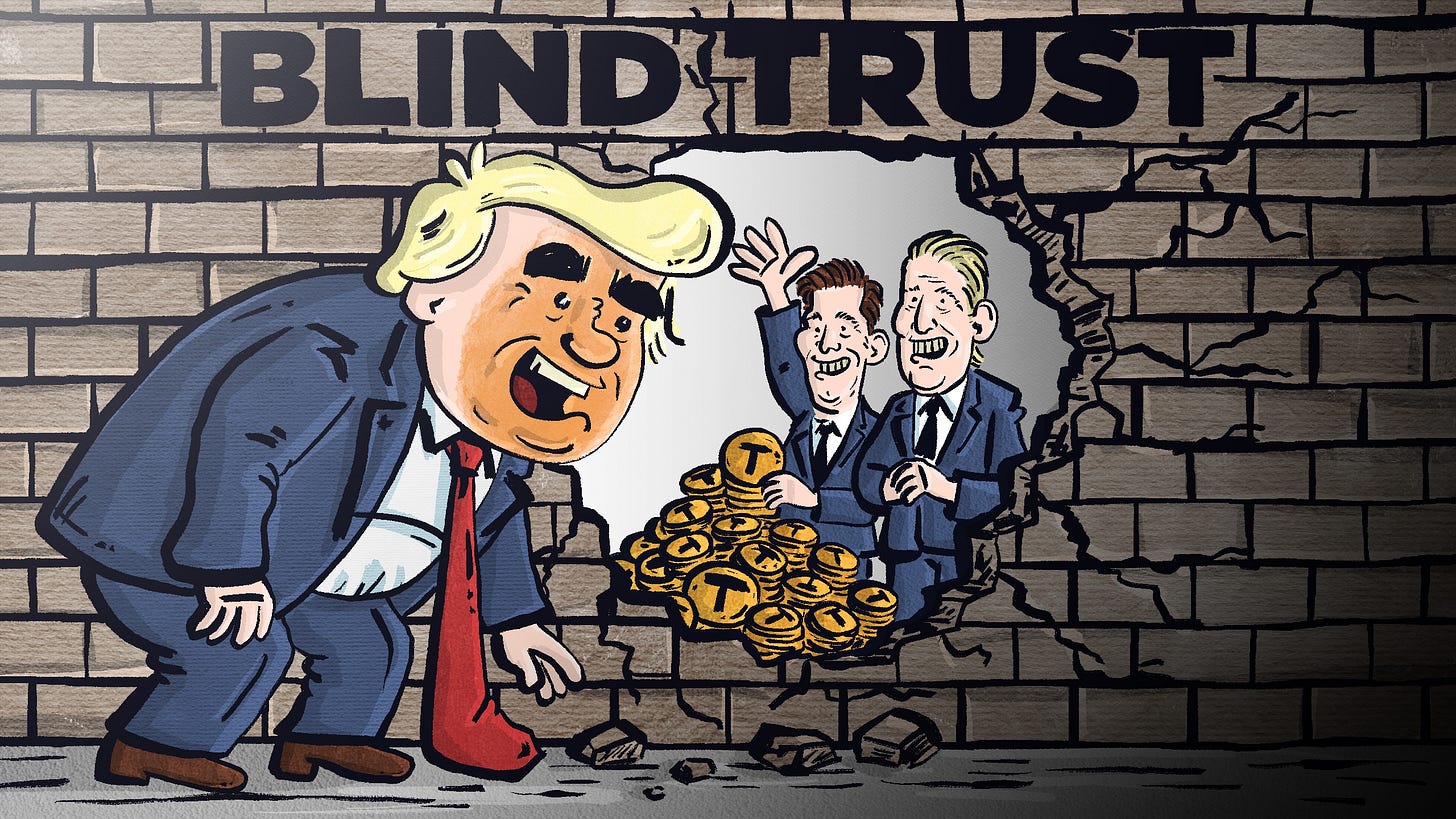

All of the president's assets are in a blind trust, which is managed by his children. And I would argue, one of the many reasons that the American people re-elected this president back to this office is because he was a very successful businessman before giving it up to publicly serve our country.

“Giving it up” was a theme Trump brought up many times in his first term. In 2019 Trump stated that being president has cost him $2 billion to $5 billion.

Unless Don Jr, Eric and Barron plan on cutting dad out of the family business, it is hard to argue that he isn’t profiting from the presidency, bigly.

For example, the terms of the initial investments made into WLFI were that 75% of the money raised went to a Trump family-owned entity called DT Marks DEFI. So of the roughly $590 million raised from the original 35,000 WLF investors, $442.5 million went to DT Marks DEFI. That is highly unusual. Money invested in a new venture typically goes to the venture itself to pay for capital expenditures, operations, marketing, etc. Not in this case.

Instead, WLF was structured more like a pure licensing arrangement, where the value created was mostly going to come from its brand, Trump. Of course, the brand and the efforts of founders are worth a whole lot of the eventual value of any company, which is why founders normally get a large equity chunk. The Trumps got that “normal” feature too (38% equity interest in the WLF holding company, and 22.5% of the WLFI token supply). And it did not end there.

ALT5 SIGMA

This August, WLF purchased a pain treatment company, ALT5 Sigma, and turned it into a crypto treasury company. The company then turned around and offered approximately $750 million in publicly-traded shares and another $750 million in WLFI. Trump’s WLF is the big winner in this odd, circular transaction.

From the Wall Street Journal:

“The deal will hand the Trump family a huge payday, around $500 million, since an entity it owns keeps up to three-quarters of any revenues from WLFI sales. This sort of circular transaction—with the same party as buyer and seller, dealing in products they themselves created—is more common in the crypto world than in traditional finance.”

The Trump family owned entity DT Marks DEFI has already received around $942m ($442.5m from initial private investments into WLF, plus $500m from ALT5 Sigma deal) in cash from this start-up. Not bad.

But wait, there’s even more!

Stablecoin USD1

Stablecoins are the bedrock of crypto payment systems. The coins are built and settled on blockchains and are backed up to 100% by liquid U.S. dollar assets such as U.S. Treasury Bills. The coins are often used for business-to-business commerce and the purchase of crypto tokens on crypto exchanges.

Stablecoins are a great concept, but they are a go big or go home product, as wide usage and adoption are critical to their value. Tether is now the dominant stablecoin, with about $169 billion of its USDT tokens currently in circulation

However, it took Tether many years to establish itself as a widely used stablecoin. The stablecoin that WLF launched in March, USD1, already has about $3 billion in circulation. That is a pretty quick start. Stablecoins are great for users such as Tether and WLF because they don’t pay interest to the purchaser. The issuer, on the other hand, earns on the cash they receive from the buyers by investing in money-market instruments like Treasury Bills. Bills are currently yielding about 4% which means for every $1 billion of USD1 in circulation, the Trumps’ WLF earns about $40 million

The way WLF was able to issue $3 billion USD1 in such a relatively short amount of time is astounding. The Sunday Times reported:

Its biggest transaction came a few weeks ago when its coins were used for a $2 billion deal between MGX, an Abu Dhabi-state backed company, to take a stake in Binance, the largest crypto exchange in the world, shortly before Trump’s business-orientated visit to the Gulf state this month. MGX, an AI and technology investment firm, is run by Sheikh Tahnoon bin Zayed al-Nahyan, the Emirati national security adviser.

A couple of weeks after this deal went down, the administration announced an agreement, giving the UAE access to advanced US computer chips.

Moreover, the other party to the big Abu Dhabi company using USD1 to purchase a $2 billion stake in crypto exchange Binance is its founder, Changpeng Zhao, or “CZ.” CZ happens to be in the market for a presidential pardon after serving four months in a U.S. prison. CZ signed a plea deal with the Department of Justice in 2023 for running a large-scale money laundering operation with his crypto exchange.

Binance has not sold any of its USD1, effectively giving key fundamental support to the token and its growth prospects.

Back to the first question I asked at the top:

Is the President using the Oval Office to benefit his family business?

Well, instead of using the profits to invest in WLF, the president’s share is going to a blind trust. Does that mean he’s not using the influence of his office to build the wealth of that trust with the help of ultra-rich investors who have ulterior motives?

If you believe the answer is no, then you might just be Karoline Leavitt!

As for average investors in WLF tokens and stablecoins, I worry they could be in for a shock. What happens to the value of these products once Trump leaves office? The Trumps and their close associates will have already made tremendous amounts of money if WLF crashes, as many crypto assets tend to do. Average investors won’t be so lucky.

WLF, WLFI and the rest of “TrumpCryptoWorld” are very different from other crypto projects because Trump-related companies are more about the brand than about any new technological or financial innovation. That brings inherent starting value while Trump is in office, but I’m skeptical that it will continue after he leaves. There are perhaps some parallels with the Clinton Foundation, which raised $2 billion while the Clintons were highly influential — including when Hillary Clinton was Secretary of State — but donations nosedived after 2016 when she lost to Trump. Like the Clinton Foundation, it is easy to see a future where TrumpCryptoWorld comes under regulatory and political attack if the Democrats retake control of government.

As Wall Street’s Gordon Gekko said, “If you’re not inside, you’re outside.”

The average investor is most definitely outside on this one, although insiders aren’t immune to experiencing problems. Sun, the $75 million investor in WLFI, complained on X last week that he couldn’t access his tokens!

I struggle with this one. Politicians of both parties routinely use insider information, their public persona and political contacts to enrich themselves. It’s a pathetic interpretation of “public service” but that’s how it is. George Washington did real estate deals throughout his presidency. So Trump isn’t breaking new ground, but that doesn’t make it any less unseemly and distasteful to me. This is especially true when Trump acts as a spokesperson for his family businesses, even if they are in a blind trust (as they should be).

Why don’t we clean all this up and make public service a temporary stint and not a career? Oh, that’s right-Congress would have to vote on it. Of course, Congress could stabilize Social Security, pass immigration reform and increase government transparency. They do none of these things that all Americans want. They blame each other for everything, work you into a lather so you’ll send them money, and build massive wealth for themselves with our system of legal grift.

We have a thing in the code of legal ethics or professional responsibility (Laugh if you want, it was important to me, and I was taught by a preeminent legal ethics professor) called the "appearance of impropriety." Even if this is all technically legal, it sure has the appearance of impropriety. And I say this as largely a Trump supporter (I am a JD Vance guy).