The SPAC is Back!

The Private Equity deal machine is in trouble, so of course it's time to bring back perhaps the most idiotic product Wall Street has ever produced.

Bloomberg News reported last week that Goldman Sachs, after a 2022 self-imposed ban, is getting back in the SPAC underwriting game.

Back in 2021, as Fed monetary policy supercharged a speculative mania, SPACs were the poster children of markets gone wild. Goldman underwrote more than $16 billion of the product in 2021 as Wall Street pumped out more than $170 billion overall, led by Citigroup’s $22 billion.

What is a SPAC?

Our fearless leader Mr. Taibbi wrote about SPACs in 2021, and it’s a great read.

Here’s a drier take.

Special Purpose Acquisition Companies (SPACs), also referred to as Blank Check Companies, are registered investment products underwritten by the likes of Goldman. Managers of the SPAC raise money in an Initial Public Offering for the purpose of buying a company or companies within 18 to 24 months.

Investors don’t know what the SPAC manager is going to buy, and sometimes they don’t even know the type of companies being sought.

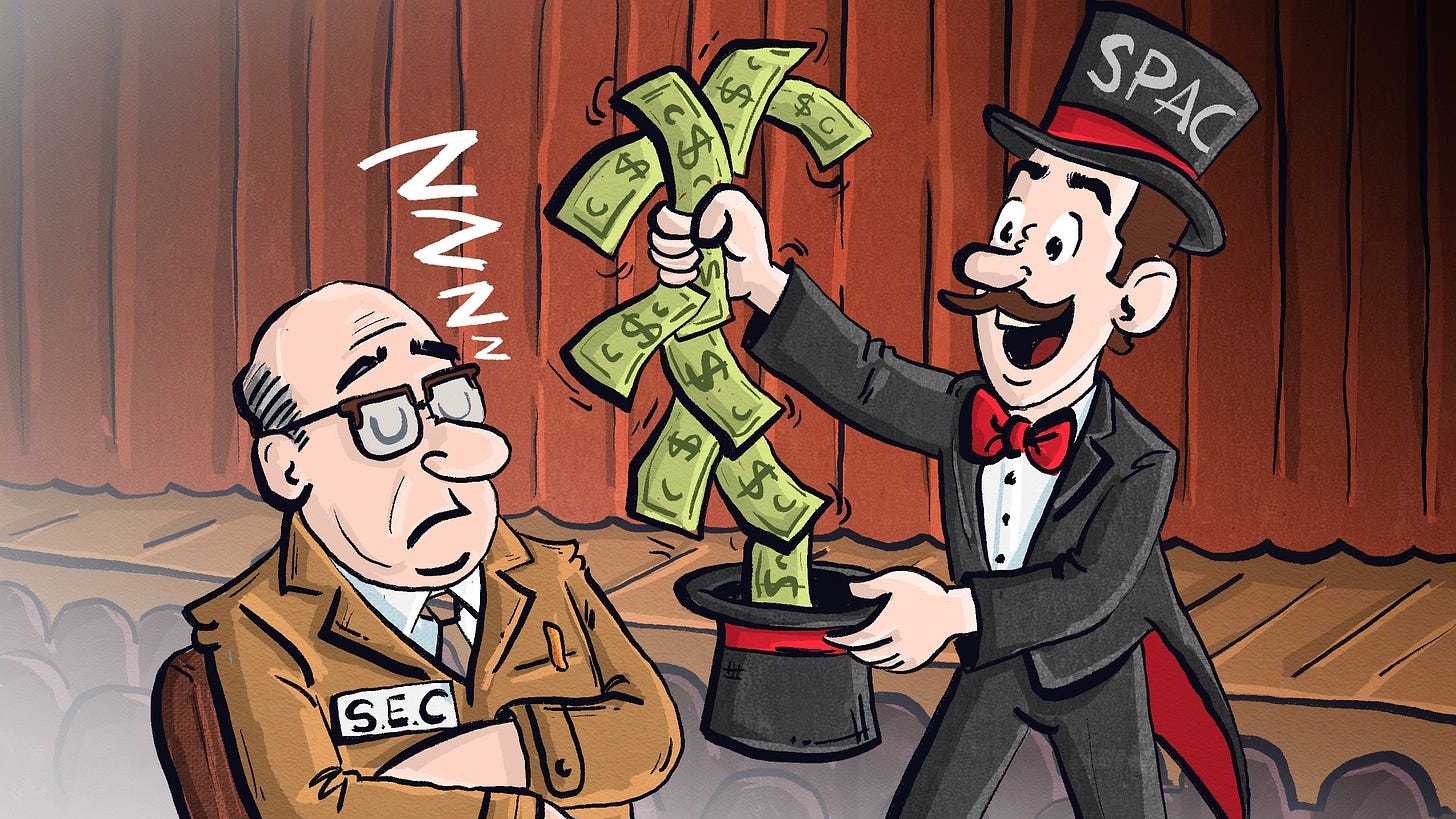

One of the awesome things about SPACs in their heyday was that they were “regulatory arbitrage.

What could possibly go wrong?

This meant that SPACs’ sponsors and investment bankers faced far fewer disclosure requirements than a traditional IPO. After all, when the SPAC doesn’t know what it will be buying, there‘s nothing to disclose! The beauty of this was that once a target company was acquired, disclosures were still fairly light. The result was that SPACs were cheaper and faster to file and carried less liability for the underwriter.

The Cost

SPAC investors pay $10 a share.

The sponsors of the SPAC pay a nominal amount, usually $25,000, to receive “founder shares,” which can be 20% of the entire deal. If the SPAC managers cannot find a company to purchase within the 18 or 24 months, the funds are returned to the investors. While the managers work on acquiring a company, investor funds are put in an interest-bearing account. If a purchase is consummated, the SPAC is “De-SPAC’d” and it becomes a new shiny public company.

From a pure comedic standpoint, SPAC-Mania in 2020-2021 was fantastic. Everybody was sponsoring a SPAC. Such notable SPAC sponsors that the common folk could invest alongside included Alex Rodriguez, Shaq, Colin Kaepernick, Jay-Z and Serena Williams! There was even a SPAC Rap by Cassius Cuvee giving props to SPACs!

It's ya boy Cassius Cuvée, you know I gotta give a shoutout to everybody in the SPAC game helpin’ me eat good these days, man it's crazy

If you in the SPAC game you know what I'm talking about

We sick of IPOs day 1 lockin’ us out

My man Randy first told me Draft Kings would go public

It's mergin' wit' a SPAC and the market gon' love it

I'm like a SPAC, what's the hell's that?

You get in on the ground floor

It paid big, so I searched and then I found more

Twitter put me up on game, well, at least most of it

Then after Nikola merger hit, it was over wit’

Feel the groove?

I’m not sure where Cassius is these days, but if your SPAC De-SPAC’d, it probably performed horribly.

Here is a nice chart of the now-defunct De-SPAC Index.

By far, the best SPAC attempt came in 2021 when Hong Kong investors teamed up with the owners of a small South Jersey sandwich shop, Your Hometown Deli, to launch a SPAC Deli!

The Financial Times reported at the time that:

Duke and Vanderbilt universities, two of the most prestigious seats of learning in the US, are among the biggest shareholders of a company that owns a single sandwich shop in New Jersey and has a stock market valuation of $100m despite recording just $13,976 in sales last year.

The deli and the SPAC are both gone now.

After standing by while more than $100 billion of SPACs were underwritten in less than a year, the SEC finally cracked down in late 2021 and took action to beef up disclosures and erase the “regulatory arbitrage,” driving Goldman’s public 2022 decision to exit the business.

Why is Goldman getting back into the SPAC business?

The first reason is relatively obvious. President Trump’s SEC has begun to roll back the stricter regulations imposed under former President Biden’s SEC chair, Gary Gensler.

While nothing has been said regarding Gensler’s beefing up of SPAC disclosures, reversing them is probably high on Wall Street’s wishlist with the Trump administration. I would argue it is a bit discomfiting that a financial product’s production rises and falls with disclosure requirements.

Wall Street is also eager to bring back the SPAC because the private equity deal machine is jammed up. The Wall Street Journal recently reported that private equity has about 30,000 unsold companies worth about $1.8 trillion that have been held for at least four years. PE has its own ecosystem, filled with investment bankers, lawyers, asset managers, asset lenders, structured product traders and salesmen and hedge fund managers relying on billions of dollars of fees every year. After all, the $300,000 exclusive country club fee, the beach house, ski lodge, and the kids’ ridiculous private school tuitions aren’t going to pay for themselves!

A few weeks ago, we reported on PE’s drive to access the $12 trillion in Americans’ 401k funds to get the deal-making machine unstuck. Another way to get at retail money to buy the aforementioned PE company backlog is to bring back the SPAC. After all, this is what SPACs do. They buy private companies. Why not kill two birds with one stone? Investment banks like Goldman can start earning sorely-needed underwriting and M&A fees with SPACs while private equity companies looking to unload companies will now have an off-ramp frequented by retail investors.

Who knows, maybe it will be different this time, but probably not.

We underestimate the power of greed -- for the Goldman Sachs of the world and for the smaller investors who buy crappy "products" like CDO's and SPACs.

They are all chasing quick profits -- without producing any goods that society needs, and without doing any real work to earn the profits.

It's hard to have any sympathy for such people. Pox on all their houses.

When the money is fake, the rest of the economy is doomed to follow.