The Fed's Independence is at Stake and it May Be Its Own Fault!

Is the Fed the beneficiary of its own “success”?

President Trump talks as if there’s nothing to stop him from getting the Federal Reserve Board chairman he wants when Jerome Powell’s six-year term ends May 15.

On Wednesday, he told the World Economic Forum in Davos:

I’ll be announcing a new Fed chairman in the not too distant future. I think he’ll do a very good job … It’s amazing how people change once they have the job, but it’s too bad. Sort of disloyalty, but they got to do what they think is right. We have a terrible chairman right now.

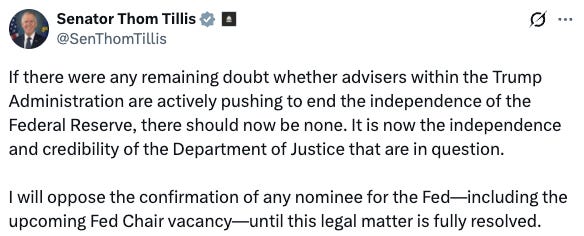

Problem is, the Trump Justice Department’s criminal investigation of Powell might get in the way. Powell came out swinging when the investigation, which relates to his testimony last summer about renovations to Fed headquarters that are about $600 million over budget, was announced. Powell said the investigation is a result of his interest rate policy. Republican U.S. Senator Thom Tillis was listening:

At the very least, Tillis can make any nomination difficult because he’s on the Senate Banking Committee, where Republicans only have a 13-11 majority. Tillis’ concern about independence was amplified by past Fed chairs Janet Yellen, Ben Bernanke, and Alan Greenspan, as well as former Treasury secretaries from both parties.

The reported criminal inquiry into Federal Reserve Chair Jay Powell is an unprecedented attempt to use prosecutorial attacks to undermine that independence. This is how monetary policy is made in emerging markets with weak institutions, with highly negative consequences for inflation and the functioning of their economies more broadly. It has no place in the United States whose greatest strength is the rule of law, which is at the foundation of our economic success.

I don’t dismiss their concern about what’s motivating the investigation. But it’s worth noting that, except for Yellen, many of the biggest names on that statement had their own stamp on the 2008 Great Financial Crisis.

With Great Powers Come Great Temptation

Investigative reporter Sy Hersh once said of the relationship between the CIA and a president,

The one virtue of the CIA is that a president, who can’t get his agenda through Congress and nobody listens to him, can take a walk in the backyard of the Rose Garden of the White House with the CIA director and somebody can get hurt eight thousand miles away.

The same could be said about the Federal Reserve and the President, especially after 2008.

Since the 2008 Great Financial Crisis, the Fed as well as central banks here and abroad assumed great powers. They dropped their policy interest rates to either close to zero or even less than zero. The European Central Bank, the Swiss National Bank, and the Bank of Japan had negative rates and implemented massive Quantitative Easing programs by buying trillions of financial assets to gain control over longer-term borrowing rates.

Equity, fixed income (bonds) and real estate markets soared in response. Consumer and corporate borrowing rates fell to historic lows and stayed there for more than a decade. I addressed this in an article a few months ago, “Gain of Function Monetary Policy.”

Additionally, extraordinarily low borrowing rates allowed federal, state, and local governments to borrow and spend at ridiculous levels without a care in the world, giving rise to moronic theories such as Modern Monetary Theory, which states that as long as a country can borrow in their own currency, it can borrow forever, only constrained by real resources.

It’s a safe assumption that any president would have a strong preference for an easing of monetary policy (lower policy rates at a minimum) as opposed to tightening monetary policy. Moreover, communicating that preference, although perhaps a lot more subtly than Trump, to the Fed Chairman has gone on for quite some time. However, by deploying extraordinary monetary policy from 2008 to 2018 and then from 2020 to 2022, the Fed has shown every president, both present and future, that those powers can juice the economy in ways that fiscal policy can rarely match. The temptation for a president to cajole a Fed chairman has risen dramatically since 2008 and I don’t expect it to end with the Trump presidency.

Members of the Fed Became Rock Stars!

Federal Reserve governors were relatively unknown when I got my start in the financial markets in 1986, and stayed that way through much of the 1990s.

Today, the whole country seems to know when the Fed’s Federal Open Market Committee (FOMC) meets, and waits with bated breath for the FOMC Statement and the Chairman’s press conference, which is covered by every major news outlet. In fact, until about the mid 1990s, the only way any of us professionals knew what the Fed was doing — or what we thought it was doing — was when we noticed that short-term borrowing rates were going sharply up or sharply down. The funding desk on the trading floor would become actively involved with the New York Fed, usually cursing that their broker-provided lunch was being interrupted. That is how we knew the Fed was changing policy. No announcements, and certainly no press conferences.

That changed in the early 1990s with Chairman Alan Greenspan, who became famously known as the “Maestro” while Fed chairman from 1987 to 2006.

And then came The Great Financial Crisis (GFC) of 2007-2009, one that “The Maestro” slept through as the bubble was building. Then Ben Bernanke became chairman, sleeping through his first year and a half of the bubble that was ready to burst, before coming to the rescue by bailing out the banking system with extraordinary monetary policy by purchasing trillions of Treasury securities and agency mortgage-backed securities. The Fed lowered its policy interest rate to near zero and bailed out banks by taking billions of dollars of subprime garbage off their books.

Speaking of books:

The Courage to Act.

By that title of his memoir I wonder if he meant courage to act as in, act like a hero trying to save us from the mess that happened right under the Fed’s nose in the first place. Probably not.

Now, whenever the Fed meets every six weeks, the event is treated like the Super Bowl and every Federal Reserve Board governor and Fed Bank president is a rock star. They are constantly being feted over on business channels such as CNBC, Fox Business and Bloomberg either for interviews or coverage of any speech or roundtable where they are featured. They also get to go to cool places like Davos and Jackson Hole (the annual symposium held by the Kansas City Fed), where they are treated like the Pope on the Vatican’s public balcony.

Why the change from grey background figures that spoke in a language few understood to A-list celebrities?

Screwing Up Has Benefits

Perversely, the Fed gained the spotlight and extraordinary powers from a crisis that it had nearly every advantage to diagnose and treat before it metastasized and triggered the financial crisis.

It was said that famous Wall Street economist Henry Kaufman, nicknamed Dr. Doom, used to walk the trading floors and hallways at Salomon Brothers, stopping to ask questions to find out how the firm was making money. He would ascertain whether the profits were sustainable and, perhaps more importantly, whether the firm was taking on too much risk. The Federal Reserve could have been doing what Henry Kaufman did with Wall Street in the early 2000’s.

You’d think if the Fed could have asked Jimmy Cayne (Bear Stearns), Stanley O’Neal (Merrill Lynch), Dick Fuld (Lehman Brothers) and Lloyd Blankfein (Goldman Sachs) to explain just how billions of dollars were being made on a foundation of pools of poorly underwritten subprime borrower mortgages with adjustable low teaser rates that exploded upward in year three could be packaged into billions of AAA credit rated securities. The Fed, however, did nothing until it was too late and then “saved us” from the disaster that was allowed to happen in part due to its negligence.

Perhaps the best way to preserve Fed independence is to lock away in a lead trunk the extraordinary policies of Quantitative Easing and zero interest rate policy that they swiftly approved in 2008, get off the cable news and lecture circuit, stay home from Davos and cancel the annual Jackson Hole boondoggle . Otherwise, the Fed’s independence will be tested time and time again, guaranteed.

You can also listen to Eric Salzman discuss this topic on his podcast, “Monkey Business.”

Son. I hate to break it to you but the Federal Reserve has never been independent ever. The fiction that the Fed has been Independent is repeated over and over again as if it’s a magical chant. If you say something over and over again you can make a lie Truth. Sort of like Vaccines are safe and Effective. Trump is a facist and Racist. Etc etc.

The Federal Reserve has been either the source or has made every financial depression or recession worse by their own policies. They have failed us in every way imaginable and they will continue to f it up.

I worked at Volcker’s Fed in my first job, and in the financial industry for much of my career. I remember well the 2007-2008 crisis when the Fed balance sheet ballooned in days.

Most economic crises and recessions have their origins in government action (remember the idea that EVERYONE should be a homeowner under Clinton’s 2nd term? This birthed the 2007-2008 crisis) So many other examples in my lifetime.

BTW, the investigation of Powell was prompted by his (arguably) perjurious testimony to Congress re. the “renovation” of the Fed building. Powell is incompetent. Some of the other governors (looking at you, Lisa Cook, of the multiple “primary residences” claimed on your mortgages) are equally suspect.

We deserve better. Thom Tillis should back off.