Lies, Damn Lies and Statistics

It's time to clean house at the Bureau of Labor Statistics, but not because of a poor jobs report that Trump says was "rigged"

When I was told Friday that President Trump fired the BLS commissioner due to a poor July payroll report (a less-than-expected monthly job add of 73,000 and very large negative two-month revision of 258,000), I waited for a laugh track that never came.

He did what? Really?

I spent most of the weekend shaking my head and laughing that the president would fire BLS Commissioner Erika McEntarfer for a lousy Non-Farm Payroll report.

Then I thought about it a bit more.

Most of us who have been in the markets have probably spent at least six of the 12 first Fridays of the month every year scratching our heads when the monthly report is released. Our staff economist leads us through the various seasonal adjustments, model adjustments, survey participation rates, data revisions to the last two reports and other assorted “kinks” in the reporting, and by the end it usually sounds like nonsense. I believe these monthly reports warrant a good dose of skepticism.

Year-over-year however, I always thought the numbers were relatively accurate, which is why I was pretty surprised when in February the BLS revised the total 2024 non-farm payroll employment level down 598,000, a revision of −0.4%. That’s the largest revision in 10 years. Annual benchmark revisions have averaged 0.1% in the last decade, ranging from less than .05% to 0.3%.

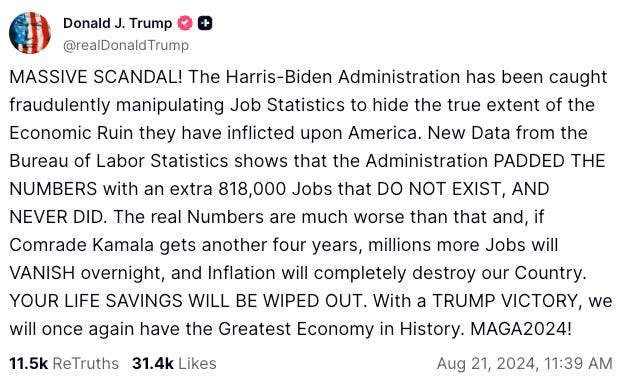

Trump already had his suspicions back in August 2024 when the BLS estimated that the 2024 revision would be a whopping 818,000 fewer jobs than previously reported.

A big negative revision for 2024 annual job creation meant that his Democratic opponent had been campaigning on inflated employment numbers. While it was probably just poor data, as Racket’s Matt Taibbi has been tirelessly reporting, the president has a very justified “trust issue” with other supposedly non-partisan organs of government, so why not the BLS as well?

It has not been a good decade for the BLS in the “trust” department. In 2022, BLS investigated a suspicious event and found it did nothing wrong. Then, in 2024, senior BLS officials blatantly lied about a release of material nonpublic information to a select group of people.

“Super Users”

The New York Times reported that in January 2024 a BLS staff economist engaged in highly inappropriate communication revealing material nonpublic information to a select group of banks and hedge funds. From the Times:

In an email addressed to “Super Users,” the economist explained a technical change in the calculation of the housing figures. Then, departing from the bureaucratic language typically used by statistical agencies, he added, “All of you searching for the source of the divergence have found it.”

To the inflation obsessives who received the email — and other forecasters who quickly heard about it — the implication was clear: The pop in housing prices in January might have been not a fluke but rather a result of a shift in methodology that could keep inflation elevated longer than economists and Federal Reserve officials had expected. That could, in turn, make the Fed more cautious about cutting interest rates.

That kind of information had tremendous value in the wrong hands.

There was an uproar when news of the Super User group leaked. When confronted in early March 2024 by news outlets, the BLS called what happened a mistake and denied there was an actual “Super Users” group, but rather a one time reply to multiple inquiries. From Bloomberg News:

“To expedite a response, the employee blind-copied a number of requesters and referred to them as super users — this was a mistake,” said Jeffrey Hill, a BLS associate commissioner.

The New York Times filed a FOIA with BLS, and found there was indeed a “Super User” list, kept by at least one “low ranking” staff economist who was communicating with a number of banks, money managers and hedge funds.

The emails show that the employee did engage in extended, one-on-one email exchanges with data users about how the inflation figures are put together. Such details, though highly technical, can be of significant interest to forecasters, who compete to predict inflation figures to hundredths of a percentage point. Those estimates, in turn, are used by investors making bets on the huge batches of securities that are tied to inflation or interest rates.

In at least one case, emails to super users appear to have shared methodological details that were not yet public. On Jan. 31, the employee sent an email to his super users describing coming changes to the way the agency calculates used car prices, at the time a crucial issue for inflation watchers. The email included a three-page document providing detailed answers to questions about the change, and a spreadsheet showing how they would affect calculations.

“Thank you all for your very difficult, challenging and thoughtful questions,” the email said. “It is your questions that help us flesh out all the potential problems.”

The questions also seemed to have fleshed out for the Super Users important changes to how the BLS was changing their calculations of the CPI two weeks before their official release in mid-February!

The Times identified several “Super Users.” Among them: Barclays, Nomura, BNP Paribas, Millennium Capital Partners, Breven Howard and Citadel.

Bloomberg News, after reviewing the documents, found JP Morgan, BlackRock and Moore Capital were also part of the group.

In response, an external team of experts was formed to investigate the incidents and suggest improvements.

While the team’s report stated that “none of the incidents were related to the quality or accuracy of the agency's core data work,” the issue of the Super User group had nothing to do with the quality of the agency’s work. Rather, it had to do with disseminating that work to a select group before it was made public.

Here is what McEntarfer had to say about the Super User incident:

It was an idiosyncratically collected group of emails of people who had been asking him questions that he put together against policies and procedures that BLS outlined, so, yeah, it was limited to one person and ceased at the moment its attention was brought to the agency.

Idiosyncratically collected group of emails? I have to give McEntarfer credit for some fantastic, institutionalized bullshit there!

How many times did this “idiosyncratic” behavior take place, who did it take place with, and what was discussed in each of these idiosyncratic exchanges? What did the members of the Super User group do with the information that they knew was material and non-public? Why did the employee provide this service?

Regarding the expert report, the McEntarger concluded:

I want to emphasize that throughout their conversations with me, the team emphasized that overall, their investigation revealed a really excellent organization with a highly capable staff, deeply committed to their mission and their agency,"

Nothing to see here, please move along

You might remember that back in 2022, inflation was raging. On the morning of December 13, 2022, the markets were on pins and needles waiting for the 8:30 a.m. November Consumer Price Index report. About one minute before the release, 10-year U.S. Treasury Futures began to skyrocket, along with equity futures. At 8:30 the BLS reported that inflation for November came in much lower than expected, something that would have caused bond and equity futures to surge higher, like they did 60 seconds prior to the release! The March 2023 Ten-Year Treasury futures saw the buying of 13,000 contracts seconds before the release, a notional value of nearly $1.5 billion.

Interestingly, while there was much hand-wringing, the incident passed without any investigation. This was a bit “disconcerting” since the Commodity Futures Trading Commission (CFTC) could have discovered who traded right before 8:30 a.m.

The CFTC could have rounded up all the Futures Clearing Merchants and had them divulge which clients placed the trades. It might have taken subpoenas and some investigative work, but the government has folks who do that sort of thing. As far as we know, this was never done, or at least disclosed.

Hilariously, White House Press Secretary Karine Jean-Pierre contorted herself into a pretzel later in the afternoon, essentially telling the press it was no big deal and if it was, the White House wasn’t the leaker!

The Labor Department conducted an initial investigation as to whether the data was hacked and dismissed the possibility of a data leak. The BLS denied any awareness of an early release of the data. Not exactly The Inquisition!

What is true is the report got into the wrong hands at the wrong time. Either somebody at BLS leaked the report, or it was a very senior official from either the Federal Reserve, the Treasury Department, or the president and/or his senior economic advisors. The odds point to the former. Either way the BLS seemed to want no part in finding out the answer to this mystery.

Personally, I don’t think that the July Non-Farm Payroll report was rigged. However, I do think the BLS has a credibility problem, which unfortunately extends beyond its statistical acumen. Once the lying and potential covering up begins, credibility is shot. There has been much talk this week about how casting doubt on our economic data is another blow to democracy. Interestingly, I have not seen any mention of either the “Super User” or the December 13, 2022, scandals in the reporting.

The timing and optics of Commissioner McEntarfer’s firing could have been much better, but it’s past time to clean house at the BLS.

Great breakdown, Eric. How much overlap do the "Super Users" have with DNC megadonors? Insider trading and bribery are legal for the limousine liberals - it's a great big club and you ain't in it!

So that is how a lowly Federal employee can afford a massive house the the DC area. Trade on insider knowledge just like Nancy P.