Following Up on Federal Reserve Governor Lisa Cook’s Mortgage Adventure

Contrary to news reports, recent disclosures produced by Lisa Cook don't aid in her defense.

The Financial Times reported September 12, 2025, that:

The documents, seen by the Financial Times, appear to contradict allegations by Federal Housing Finance Agency director Bill Pulte, a Trump ally and frequent critic of the central bank, that Cook had claimed the Atlanta condo and another property in Michigan were both her principal residences. The first document, a letter from the Bank-Fund Staff Federal Credit Union dated May 28 2021, shows estimates of costs associated with the purchase of a $625,000 property in Atlanta, Georgia. The loan estimate states the property would be used as a vacation home. The second document, an SF-86 supplemental questionnaire dated December 3 2021, shows that, when asked to list all of her interests in real property, Cook listed the Atlanta address as her second home. The government uses the SF-86 to conduct background checks for positions deemed important for national security.

Vindication? I don’t think so.

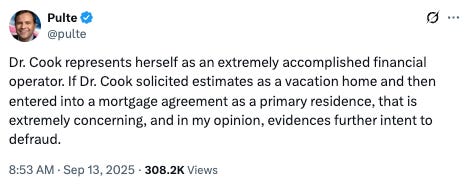

Pulte alleges that she represented in her mortgage agreement for both houses, within two weeks of each other, that she would move into them within 60 days as her primary residence for at least one year. If that’s true, the documents referenced above don’t necessarily override those representations.

CNBC also threw its hat into the ring of dumb reporting with a different angle on the “vindication of Lisa Cook” when it reported:

The rates on Cook’s two mortgages show Cook didn’t enjoy discounts compared with prevailing rates available to borrowers when she negotiated the loans in 2021.

Her rate on the 15-year loan on the Michigan property was 2.875%, versus a prevailing national rate in that period ranging from 2.23% to 2.45%, according to Freddie Mac data. And her rate on the 30-year loan on her Atlanta property was 3.25%, versus a prevailing rate at the time ranging from 2.93% to 3.04%, according to Freddie Mac data.

This take is meaningless. The Freddie Mac data comes from their Primary Mortgage Market Survey Rate (PMMS). Here is Freddie’s description of the PMMS:

“Lenders surveyed each week are a mix of lender types – credit unions, commercial banks and mortgage lending companies – is roughly proportional to the level of mortgage business that each type commands nationwide.”

The Freddie Mac PMMS rate is a weighted survey that publishes one rate on the Thursday of each week. From the description above, the survey is weighted by lender type, non-bank mortgage originators (such as Rocket Mortgage), commercial banks and credit unions. In 2021, non-bank mortgage companies originated 63.9% of first lien home mortgages, with banks and credit unions making up the difference, according to the Consumer Financial Protection Bureau. Cook received her mortgage on the Atlanta residence from Bank-Fund Staff Credit Union. Since the PMMS is a weighted average, Cook’s mortgage rate of 3.25% could very well be where her credit union was lending to borrowers purchasing a home as their primary residence.

Did Cook get a rate that would be associated with a loan on a primary residence or a secondary one? It should be relatively easy to find out if the rate she received on her Atlanta mortgage was at a “discount” by having Cook’s credit union show what rate they were charging on conventional mortgages on primary residences on the day or the week Cook was given her mortgage. If the rate they were charging was significantly lower than 3.25% (0.25% or more), she didn’t receive a discount, and if it was 3.25% or higher, she did.

However, whether she got a discount or not, the thing to keep in mind is that making false statements on the mortgage deed of trust is a felony. That seems to be getting lost in this argument.

President Trump cited “false statements on one or more mortgage agreements” in firing Cook last month, but courts are letting her stay on the job while she argues he doesn’t have the authority to take such action. The Trump administration is seeking an order from the U.S. Supreme Court to let the firing take effect.

Cook’s attorneys argue in a Thursday filing that her removal “would signal to the financial markets that the Federal Reserve no longer enjoys its traditional independence, risking chaos and disruption.”

This filing came after a group of former Fed chairs, treasury secretaries and White House economic advisers — Bloomberg calls them “economic luminaries” — filed a brief that urges the Supreme Court to let Cook remain a Fed governor while her lawsuit proceeds:

Granting the government’s request to remove Governor Cook from the Board immediately would upset these longstanding protections and the essential functions they serve. Doing so would expose the Federal Reserve to political influences, thereby eroding public confidence in the Fed’s independence and jeopardizing the credibility and efficacy of U.S. monetary policy. Maintaining the status quo while the lawfulness of the termination is adjudicated, in contrast, would serve the public’s interest by safeguarding the independence and stability of the system that governs monetary policy in this country.

Does a Federal Reserve Board governor defending herself from accusations of mortgage fraud damage the Fed’s credibility? Most of the media and the “economic luminaries” seem to be cruising right past that question.

Cook was not a Fed governor when she took out the loans. Should that matter? I don’t think so. Given the Fed’s influence, its governors and presidents can’t be seen as getting a pass on alleged financial crimes, as they have in the past. Last year, the Fed’s Office of Inspector General found that former officers didn’t disclose trades they were making in 2020 while they were deciding an emergency interest rate cut as the economy was shutting down due to the Covid pandemic.

In addition to Fed officials, we have federal judges and government officials trading on material non-public information, also known as insider trading.

And of course, members of Congress just happen to make a killing while in office. There are even ETFs tracking the trades of Congresswoman Nancy Pelosi and Sen. Ted Cruz under the tickers NANC and KRUZ!

Additionally, our fearless leader Mr. Taibbi wrote a piece back in 2017 taking former Senator Bob Corker to task for his multi-million dollar day trading operation.

Remember the uproar all this reported crime caused?

No?

Me neither.

It's so tiring watching the media pretend not to understand something.

Loan estimates are completely irrelevant when we're talking about fraud on the actual mortgage paperwork. Are we expecting authorities to demand (and consider) documents that aren't even part of the actual process?

I know Orange Man Bad and all that, but whose fault is it that Cook lied on her application? Not Trump's.

As someone who actually is involved in this industry, I would add to Eric's point that it is meaningless to cite that the Freddie average was lower. It is just that, an average and without knowing if Cook was getting a higher rate to lower closing costs or knowing whether her rate was higher because she was putting less down or had a lower credit score or some combination of the two, one really can't draw any conclusion from the difference. The only useful comparison would be to see the Credit Union's rate sheet for the day she locked in including rates for both single family owner occupied and second homes. It is a sliding scale and the rate may have been close to the Freddie average if she were paying a point but if she was trying to trade a higher rate to reduce closing costs (out of pocket costs), it could easily match the rate she actually got. A lot of people do that- they will take a rate a half point higher to get thousands in credit to offset closing costs and thus out of pocket expenses. It is especially so in cases where they are trying to buy multiple properties in a short period of time. Oh, and mortgage fraud is a big deal. We had a banking crisis 17 years ago in part because of mortgage fraud, poorly underwritten loans, greedy Wall Streeters and others securitizing those loans, and bad government policy but a lot people lied about their income and other things to get loans for sure. And most of these loans, including the ones Cook got, are backed by the government through Fannie and Freddie Mac. That is why they come under Pulte's purview.